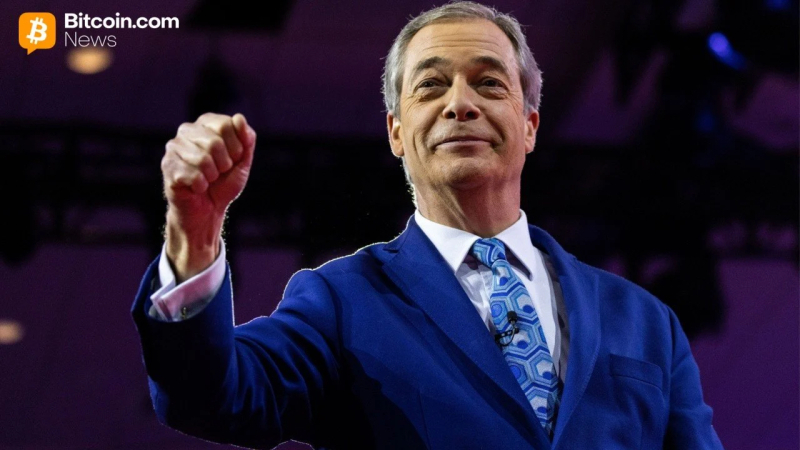

Nigel Farage Discloses $288,000 Stake in Former UK Chancellor’s Bitcoin Treasury Firm

British opposition leader Nigel Farage has established himself as a leading crypto advocate by investing $288,000 in Stack BTC Plc, a bitcoin treasury firm chaired by former Chancellor Kwasi Kwarteng.